restaurant food tax in maryland

Individuals who do not have a permanent sales tax license are required to obtain a temporary license and collect a 6 percent or 9 percent sales and use tax for sales at various events such as craft shows and fairs. If you need any assistance please contact us at 1-800-870-0285.

Maryland Sales Tax Small Business Guide Truic

Items like alcohol and prepared food including restaurant meals and some premade supermarket items are charged at a higher sales tax rate than general purchases.

. Conduct a pour test. Frederick Sales Tax Calculator. The Maryland Food Donation Pilot Program was signed into law by Governor Larry Hogan in 2017It allows farmers to donate eligible food in return for a tax credit against State income taxes.

Compare purchase orders to revenue. Several examples of exceptions to this tax are foods considered to be snack foods most prescription medications in addition to most medical devices and all types of farm equipment. Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store.

In some states items like alcohol and prepared food including restaurant meals and some premade supermarket items are charged at a higher sales tax rate. The Annapolis Maryland sales tax is 600. Due to a 2012 law change for sales made on and after July 1 2012 charges for alcoholic beverages are subject to tax at the 9 rate and charges for mandatory gratuities are subject to the 6 rate regardless of whether the gratuities relate to sales of alcoholic beverages or sales of food and non-alcoholic beverages.

The Baltimore Maryland sales tax is 600 the same as the Maryland state sales tax. The MD sales. This includes the sale for consumption off the premises of crabs and seafood that are not prepared for immediate consumption.

Arizona Georgia Louisiana Massachusetts Michigan Nebraska Nevada New Mexico South Carolina Vermont and Wyoming. Annapolis Sales Tax Calculator. The Frederick Maryland sales tax is 600.

LicenseSuite is the fastest and easiest way to get your Maryland foodbeverage tax. Please note that the sample list below is for illustration purposes only and may contain licenses that are not currently imposed by the jurisdiction shown. Generally food products people commonly think of as groceries are exempt from the sales tax except if they are sold as a meal from a restaurant.

Treat either candy or soda differently than groceries. If you need any assistance please contact us. Items like alcohol and prepared food including restaurant meals and some premade supermarket items are charged at a higher sales tax rate than general purchases.

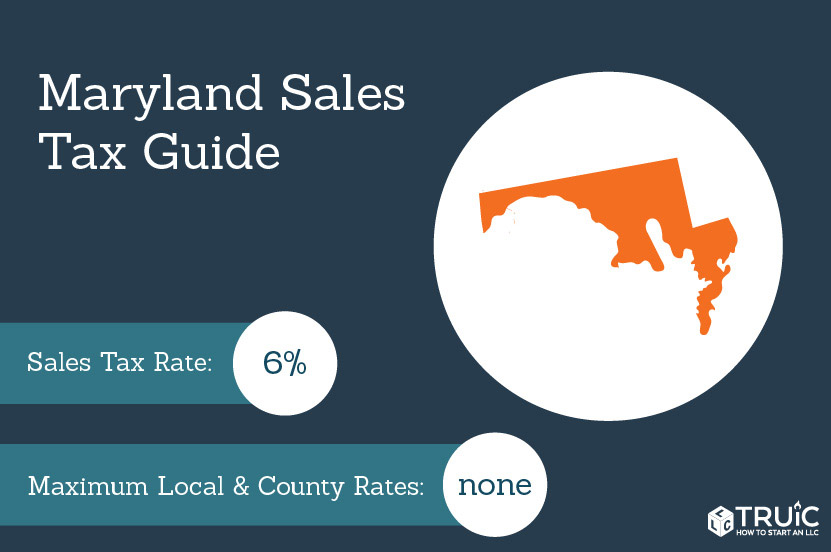

If whiskey costs 5 per shot each bottle should generate 85100 in revenue. Temporary Sales and Use Licenses. The Maryland sales tax rate is 6 as of 2022 and no local sales tax is collected in addition to the MD state tax.

Eleven of the states that exempt groceries from their sales tax base include both candy and soda in their definition of groceries. The tax is 625 of the sales price of the meal. In the state of Maryland sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

The program was originally launched exclusively in Southern Maryland and Montgomery County but was expanded statewide and will now continue through 2021 following the passage of. While many other states allow counties and other localities to collect a local option sales tax Maryland does not permit local sales taxes to be collected. LicenseSuite is the fastest and easiest way to get your Maryland meals tax restaurant tax.

Sales and Use Tax. Please note that the sample list below is for illustration purposes only and may contain licenses that are not currently imposed by the jurisdiction shown. 625 of the sales price of the meal.

Note that in some areas items like alcohol and prepared food including restaurant meals and some. If three months worth of purchase orders are compared to total drink sales and the numbers dont add up additional taxes may be owed. A grocery or market business is considered substantial if sales of grocery or market food items total at least 10 percent of all sales.

In general sales of food are subject to sales and use tax unless a person operating a substantial grocery or market business sells the food for consumption off the premises and is not a taxable prepared food. Twenty-three states and DC. Sale of food that is exempt from the state sales and use tax Under Section 11-206 of the Tax-General Article of the Annotated Code of Maryland.

Sale of food or beverage from a vending machine. Business Tax Tip 5 How are Sale of Food Taxed in Maryland. Exemptions to the Maryland sales tax will vary by state.

To obtain a temporary license call 410-767-1543 or 410-767-1531.

Best Places To Eat In Las Vegas On A Budget

Our Fogodechao Benefit Dinner Soldout In Only A Few Days Special Thanks To Everyone Who Made A Rese Junior Achievement Financial Literacy Family Night

Exemptions From The Maryland Sales Tax

How Much Tax For Maryland Restaurants Santorinichicago Com

Champagnes Cafe Champagne Cafe Fine Food

Tersiguels Restaurant In Ellicott City Ellicott City Maryland Ellicott City Ellicott City Md

![]()

Restaurant Meals Program Maryland Department Of Human Services

Everything You Need To Know About Restaurant Taxes

Food Mom Pop Pizza Subs California Maryland Pizza Wings

Bud S At Silver Run Home Westminster Maryland Menu Prices Restaurant Reviews Facebook

Punching The Meal Ticket Local Option Meals Taxes In The States Tax Foundation

What Is The Food Tax In Maryland Taurus Cpa Solutions

Sales Tax On Grocery Items Taxjar

A Tradition Of Excellence Easter Dinner Restaurant Octopus Carpaccio

Restaurant Meals Program Maryland Department Of Human Services

Captain S Table Monroe Restaurant Reviews Photos Phone Number Tripadvisor Mini Taco Appetizer Food Out Taco Appetizers